For decades, the cleanroom product industry has operated with stable costs and prices, predictable supply chains, and reliable demand forecasts. In 2020, the COVID-19 pandemic disrupted this stability, leading to long-term cost fluctuations and competition for critical raw materials.

Although much of the world has recovered from the disruptions caused by the pandemic, the global supply chain is still stabilizing. Now, cleanroom product pricing is beginning to realign to reflect the evolving dynamics of the current market.

Table of Content

The COVID-19 Impact on Cleanroom Product Pricing

Shifting Market Dynamics in 2023 and 2024

Cleanroom Product Price Adjustments Coming in 2025

Staying Vigilant in a Changing Market

Pending Tariffs and Global Trade Uncertainty

The COVID-19 Impact on Cleanroom Product Pricing

During the COVID-19 pandemic, cleanroom product costs surged due to skyrocketing demand for personal protective equipment (PPE), which shares raw materials with cleanroom products.

Key materials like nitrile, latex, and polypropylene became scarce, causing prices for products like nitrile gloves, used in both cleanroom and medical settings, to increase by up to 10 times pre-pandemic levels. Shipping delays, labor shortages, and production slowdowns further inflated these costs.

Although global supply chains began stabilizing in 2022, challenges like higher transportation, labor, and energy costs persisted.

Shifting Market Dynamics in 2023 and 2024

While PPE prices remained high into 2023, by mid-year many healthcare and industrial channels were reporting excessive inventory levels, particularly for boxed gloves.

Medical grade boxed gloves are not equivalent to cleanroom gloves, however, they share common raw materials. The oversupply of boxed gloves in the market, combined with a return to pre-pandemic demand for latex and nitrile, contributed to a reduction in product costs.

Cleanroom Product Price Adjustments Coming in 2025

Moving into 2025, pricing for cleanroom products is expected to reflect the ongoing shifts in the global supply chain, including:

- Raw Materials

- Labor

- Transportation & Logistics

- Tariffs & Trade Agreements

While some shifting costs may lead to price increases, the stabilization of raw material costs and other adjustments could also result in price reductions for certain products. Pricing realignments will be reflected across the entire Valutek product range as adjustments are made to match current market conditions.

Raw Material Costs

Acrylonitrile Butadiene Rubber (NBR), the primary material used in glove production, has seen significant price increases since 2020, while polypropylene, used in the production of cleanroom apparel, masks, and shoe covers, remained stable in 2024 after years of volatility.

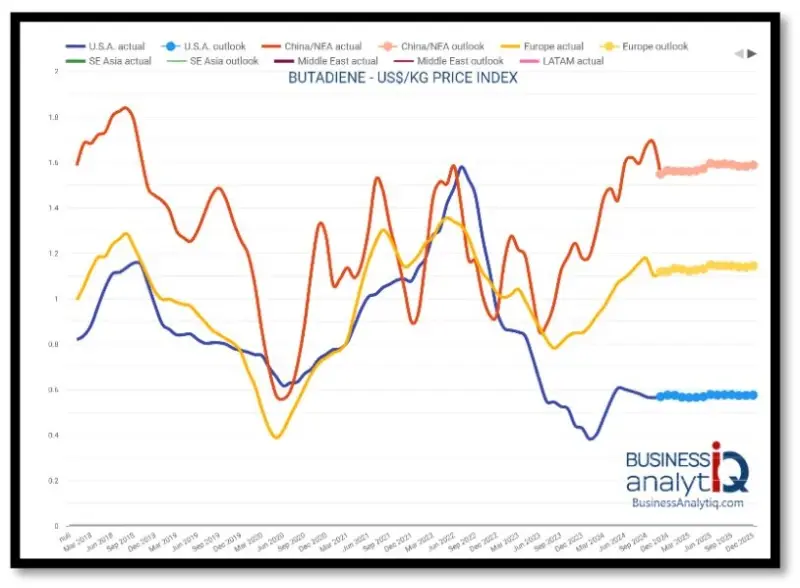

Butadiene Nitrile Costs:

Rising demand and supply constraints in China and Europe have led to a 17% price increase from 4Q 2023 to 3Q 2024.

Ongoing US tariffs on Chinese PPE and medical gloves will strain Southeast Asian capacity, likely sustaining this upward trend.

Butadiene remains the largest raw material cost in glove production.

Source: Business AnalytiQ, November 2024.

While the supply of raw materials like nitrile, latex, and polypropylene has largely stabilized, fluctuations in the global supply chain will still occur due to demand surges or supply chain bottlenecks.

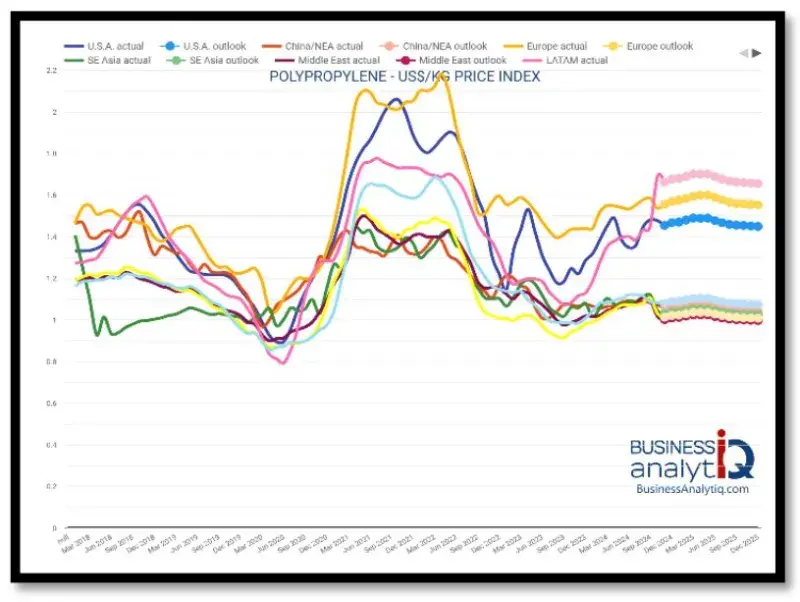

Polypropylene Costs:

Polypropylene, used in cleanroom apparel, masks, shoe covers, and packaging, saw stable costs in 2024 after three years of volatility.

A moderate increase is expected in 2025 due to planned capacity downtimes and the impact of typhoons and hurricanes in SE Asia and the US in 3Q 2024.

Source: Business AnalytiQ, November 2024.

Labor Costs

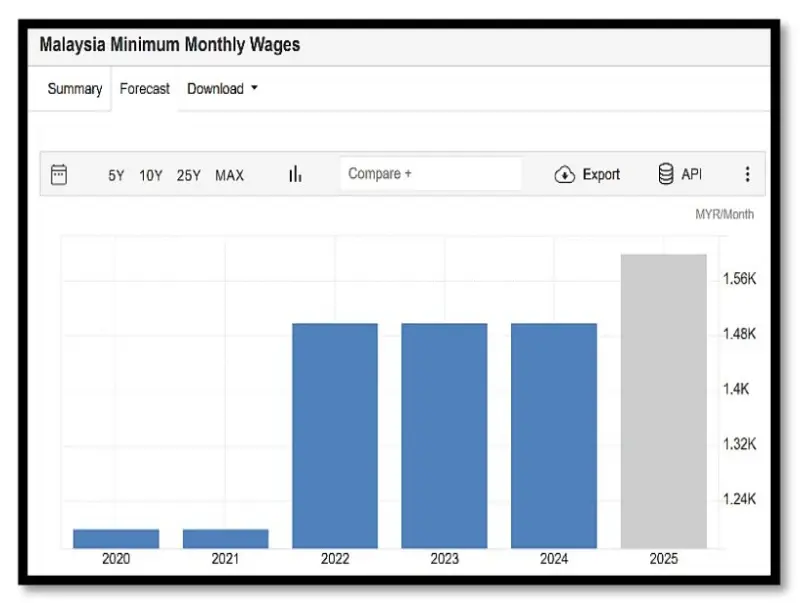

Ongoing labor shortages and wage inflation in key regions will likely continue to impact production costs. Labor costs, particularly in Southeast Asia, remained stable in 2024, however, a 12-14% wage increase is expected in 2025.

Malaysia Labor Costs:

Overall manufacturing labor costs in Malaysia move concurrently with the minimum wage. Although wages remained stable in 2024, they are anticipated to rise 12-14% in 2025.

The last significant increase was 25% in May of 2022.

Source: The Edge, October 2024

This increase is likely to drive higher production costs for manufacturing and assembly operations.

Energy and Freight Costs

Natural gas prices remain volatile due to global market conditions and geopolitical factors. Similarly, freight rates have surged, driven by global conflicts, limited port capacity, transit lane restrictions and new labor contracts.

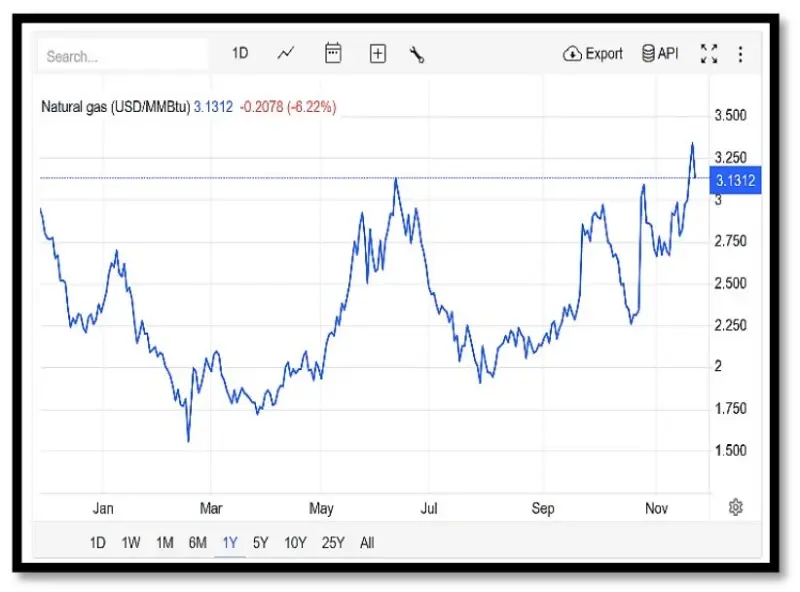

Natural Gas Energy Costs:

Natural gas prices are influenced by global market conditions, industrial demand (+11%), and SE Asian government subsidies.

Prices spiked in 2Q 2024 but remain slightly lower year-on-year.

Ongoing global conflicts and restrictions in the Red Sea transit lanes are expected to drive up gas prices in SE Asia in 2025.

Source: IEA November 2024

In addition to these factors, changes in global trade policies, container shortages, and rising fuel prices are contributing to higher overall shipping costs, further impacting pricing.

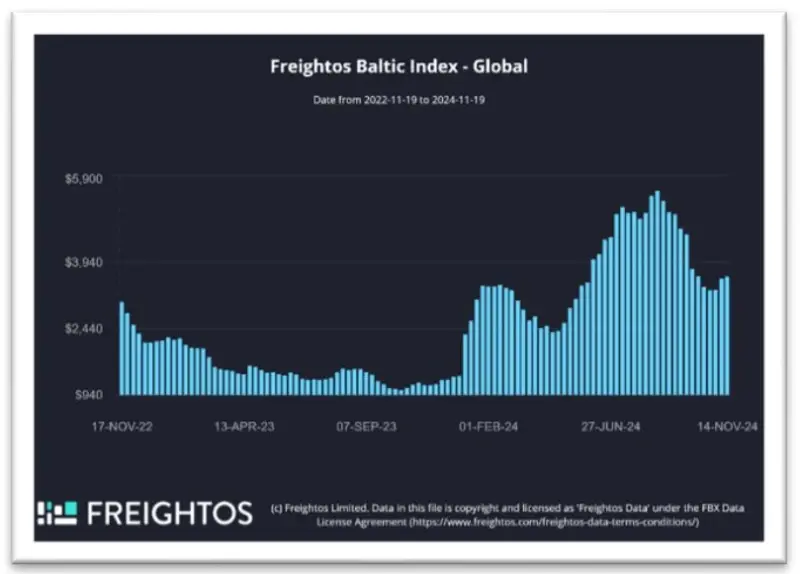

Global Freight Costs:

After slumping in 2023, Asia to West Coast freight rates have risen by 61%.

This increase is expected to continue in 2025 due to Middle East conflicts, limited port space on the US West and East coasts, and new labor contracts that raised port workers' wages by up to 45%.

Source: Freightos.com, November 2024

Pending Tariffs and Global Trade Uncertainty

Tariffs on certain industrial products from specific countries of origin continue to be implemented. At the same time, many global trade agreements are being reevaluated, which could result in increased costs.

Additionally, some manufacturers are shifting production to new facilities in different regions to build supply chain redundancy. These adjustments will come at a cost that will ultimately impact consumers.

What Does This Mean for Your Cleanroom Operations?

Understanding the underlying variables behind price realignment is crucial to operating a successful cleanroom or controlled environment.

While the stabilization of raw materials is positive, ongoing global supply chain challenges mean that cleanroom product manufacturing and transportation costs are likely to remain at current and/or elevated levels for the foreseeable future.

Staying Vigilant in a Changing Market

In the post-pandemic market, some manufacturers are still offloading excess inventory, often at lower prices. These products may be non-compliant, defective, or nearing the end of their useful shelf-life, causing them to fail to meet regulatory standards. It’s critical to work with trusted manufacturers who are committed to product quality and compliance.

It’s also important to track how and when your suppliers adjust pricing. Are you accepting blanket price increases without justification, or are the adjustments based on documented changes in component costs and price indices? Transparent manufacturers will communicate proactively about pricing shifts and the industry trends that are causing them.

For success in managing critical cleanroom products, remember to:

- Stay informed and proactive

- Adjust purchasing strategies as needed

- Carefully qualify any new product sources

- Audit your suppliers and distributors

- Routinely test cleanroom products to verify they comply with published specifications.

While many manufacturers have struggled with pricing instability, Valutek has held pricing steady for over three years, demonstrating a commitment to consistency and customer trust. By remaining vigilant and informed, you can navigate the evolving market with confidence, ensuring that your cleanroom operations meet the highest standards.

EXPLORE MORE RESOURCES:

2024 Cleanroom Product Cost Analysis: Adapting to Supply Chain Realities

Valutek

Valutek is one of the first and few manufacturers to offer a full product portfolio of best-in-class cleanroom products. Since 1988, our controlled environment consumables are helping leading organizations operate their cleanrooms in a consistently stable state.

Related Articles

- Valutek

- 2 November 2023

Shocking: Mitigating the Risk of ESD in Controlled Environments

Everyone has felt electrostatic discharge – or ESD – as the mild shock when you touch something or...

- Valutek

- 25 February 2022

Recycling Cleanroom Gloves Is Imperative

Recycling is consequential for the environment. Cleanroom gloves are the most commonly used product...

- Valutek

- 27 March 2023

What Hidden Contaminants in Cleanroom Gloves Put Yields at Risk?

Your cleanroom gloves help to keep your controlled environment free of contaminants. Right?

How do...